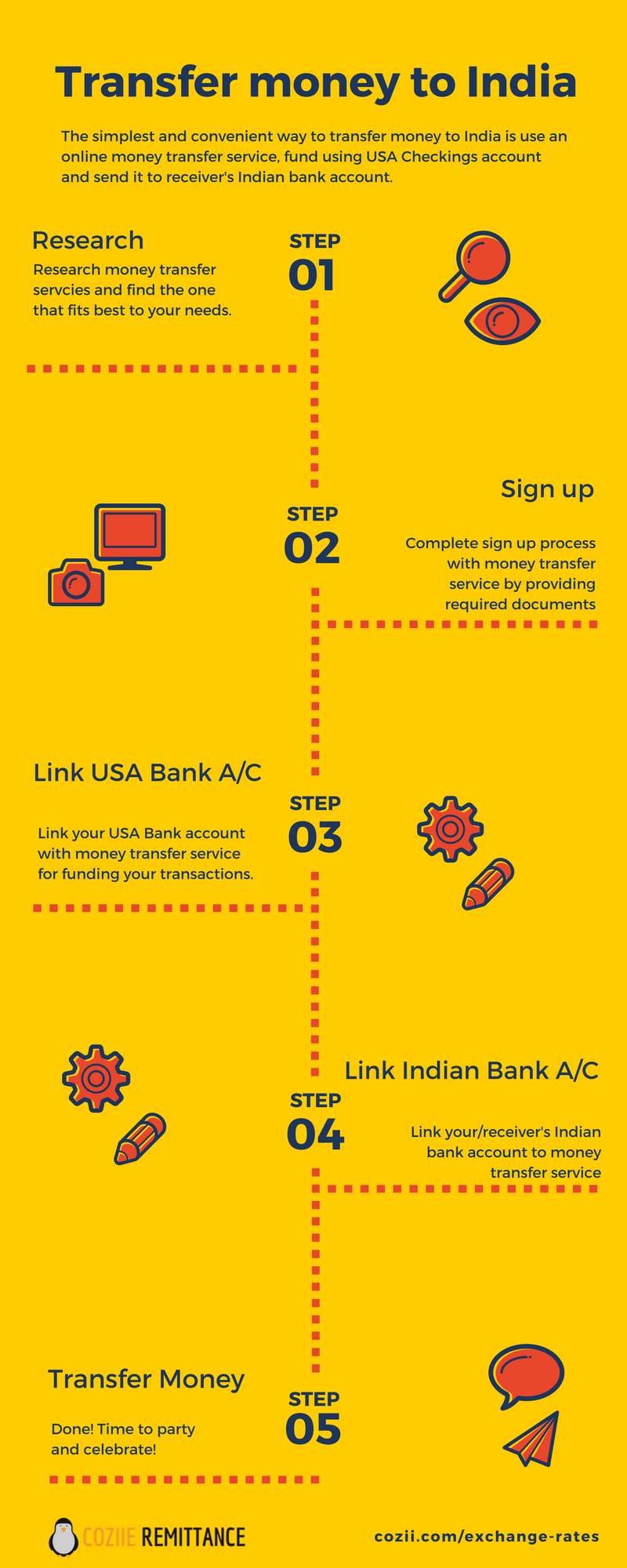

How to transfer money to India from USA

There are several ways to transfer money to India from USA and the process of transferring generally vary by three factors. Money transfer company you use, source of your money in USA and the way receiver collects money in India are the three factors. The simplest and most convenient way to transfer money to India is to use an online money transfer service, fund the transaction using USA bank checkings account and deposit to receiver’s Indian bank account. Let’s go through how to transfer money using this simplest way.

1. Research money transfer companies to India

The first step in transferring money to India is to find a good online money transfer company. If you already figured out a good one then skip reading this section. A good money transfer company makes a lot of difference to your money transfer experience. It’s worth spending time to research various money transfer companies available online and pick one.

Informative websites that curate information

There are several third party websites dedicatedly available these days to help you research money transfer companies. These websites provide editorial reviews, deeper insights and curiate all useful information at one place. Few sites that offer such information is Coziie, CompareRemit and ExchangeRateIQ. These sites generally provide a single page source for all the information you may want know about a money transfer company starting from today’s exchange rate, fees, transfer times to support options.

User Reviews

User reviews are one of the best sources to research money transfer companies. They provide un-edited, raw and sometimes emotional information about money transfer services. The best site to read reviews is TrustPilot where you can search for a money transfer company you want to review and read the information. Keep in mind that some of the reviews you read there may not be related to money transfers to India but instead related to other countries. But these generally give a sense of services offered.

Though finding a good remittance service is an important step, you should not get stuck in this step. Try to pick one to the best of your ability and move on. If you don’t find a good service on your first attempt then don’t worry as you can always sign-up with others. Signing up with new money transfer company is as simple as setting up a social network account (okay, we are exaggerating here). You should not be afraid to try various remittance services available to transfer money to India.

2. Sign up with a money transfer service

After identifying the money transfer service to India, create an account with the money transfer service by providing your basic information like name, address and email address. Most of the money transfer companies have very simple and easy process to sign up.

Every customer who signed up at one stage needs to be verified by money transfer companies to prevent fraud. For this purpose you will be asked to provide documents to verify your personal details. You may need to submit one or more of documents like SSN, passport, state id/driver’s license. You would need to upload the scanned documents online or call customer care center to provide the details. If any company asks you to send the documents through snail mail, then run to woods and hide from them forever.

3. Link your USA bank account

Now that you have signed up with a service for transferring money to Indian bank account, it’s time to link your USA bank account. You may need your USA bank account number, routing number and they are usually found on your check leafs as well as on bank’s online portal.

The details like name, address of the bank account linked must match with the personal information you provided while signing up with money transfer service. Any mismatch in information may cause unnecessary delays when you initiate money transfer requests; worst case they may close your money transfer service account.

Also make sure that your USA bank account has enough cash reserves before initiating money transfers to Indian bank account. Who likes to pay hefty overdraft fees!

4. Link receiver’s Indian Bank Account

Next step is to link receiver’s Indian bank account to your money transfer service. This step is fairly simple and straightforward if you know receiver’s name, account number, bank branch name, bank IFSC/SWIFT code. Key in all the details and make sure that you got the details right, otherwise you may end up transferring to which you never wanted to.

Along with account details of receiver’s, you may have to provide details like their address, phone number and email address. These details will be used for tracking purpose as well as to send alerts when money transfer completes.

5. Transfer money to India

You are all set to initiate your first money transfer to India if you performed all the above steps. Well, this is the most important one and you must plan properly.

Plan ahead to get better exchange rate

Money transfer companies provide better exchange rates if you opt for slow delivery otherwise you get sub-par exchange rates when you want quick delivery. You get to choose between either faster delivery or better exchange rate. The difference in exchange rates is generally between 40 paise to 1 rupee per dollar. So plan ahead of the time and save money.

Transfer small amount on first transaction

If you are transferring money for the first time (or to a new receiver) we recommended you to be cautious. To avoid transferring to wrong account or any other potential rookie mistakes, we suggest you to transfer small amount first. This helps to validate you are doing it right and afford if something goes wrong.

After validating that everything is good on your first transaction, you can make the final transaction transaction with desired amount.

6. Track the transaction to completion

Very few money transfer services provide instant to couple of hours money transfer options and others generally take one day to 3 days. If the service you used to transfer money to India needs a day or two, then it is a good idea to track the transfer request.

The money transfer service send email and message alerts to phones with updates. Keep a tab on them as well as check your USA bank account statements to see how much money is debited. If you something unexpected is noticed then reach out to money transfer company support. Check detailed information available on support options and contact details of money transfer companies.

How to transfer money to India